Some free pointers on how you can build business credit within 2-3 months.

1. Get a DUNS Number

Just like with your FICO score, you cannot have personal credit without a social security number, the DUNS number will help your vendors identify you. Experian gets reported without a specific number, and the D&B needs something called the DUNS number. Many suppliers will report to your credit. Go to Dun & Bradstreet and apply for a DUNS now.

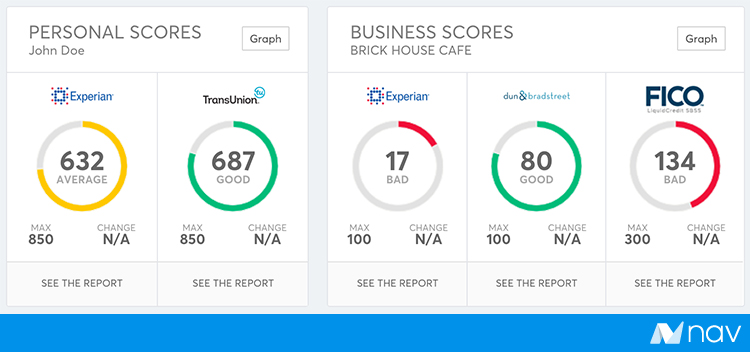

Experian’s Intelliscore Plus and D&B’s PAYDEX Score are ranked 1-100.

Please see this extensive article on Nav about these two scores.

2. Have current Vendors report properly

You can encourage your suppliers to report your business payment history to Experian. Simply click here to view a letter template and send your request to your current supplier’s contact information.

(Please note that suppliers with fewer than 50 employees generally do not have the technology or personnel to prepare the information required to report your payments to a credit reporting agency.)

3. Get Vendors that Allow Net-15 and Net-30 Payments

They always say to keep people reading your site, but this is just too good information for me to re-type.

Nav has a fantastic article how to get what looks like on a business credit report as a Line of Credit. The more you get the merrier. There are many many resources online, you can also go to your local Staples ask them for a Net-30 account!

Here is a list you can download of various Vendors that extend credit. Imagine having 30 lines of credit on your business!

4. Update Your Business Information if you are enrolled in DUNS

When you’re trying to build your business credit rating, details matter. And one of the areas where attention to detail can falter is in the myriad of applications, filings, and documents needed when starting up a business or entering into a new agreement with suppliers and vendors. If your business moves, changes names, or gets a new phone number, Dun & Bradstreet may not be able to match recent information with the right business. Make sure to keep the business’s information separate from your own; don’t list your personal cell phone number if the company has a dedicated line. In order for a business to help effectively build and maintain its credit, all of its supporting documents should feature the exact same information on file with the business credit bureaus.

Solution: Luckily, Dun & Bradstreet makes it easy to edit business details through its free Company Update tool. It’s a good idea to review this information on a regular basis to help ensure it reflects the current state of your business.

5. Incorporate

Most importantly for the purposes of this discussion, a sole proprietorship cannot establish a separate business credit file. That means potential lenders and partners will only have your personal credit history to go on when considering doing business with your sole proprietorship. Your past financial mistakes can impact the credibility of your business. Likewise, your business’s defaults, missed payments, or other financial struggles can damage your personal credit score.

A corporation is a separate legal entity that can build its own business credit file. Why is this important? Detrimental information added to your personal credit file should not damage that of the corporation. Conversely, your personal credit score should be somewhat insulated from the actions of your company. This would not be the case if you operated as a sole proprietorship.

6. Correct Mistakes on Experian Business

If you have a current copy of your company’s business credit report and believe some of the data to be inaccurate, please:

- Circle the item on the report

- Add a brief explanation of why you consider the information to be incorrect

- Supply us with the correct information when possible

- Include supporting documentation when available

We recommend that you look closely at the “key score factors” section of the report. Corrections to data mentioned in this section may result in adjustments to your credit score.

Attach the report to a cover page with your full business name, current and previous addresses, email, and a short note asking us to investigate the items you’ve marked. Email it to BusinessDisputes@Experian.com

6. Correct Mistakes on D&B Report

D&B’s business credit reporting attempts to provide accurate business information, but sometimes reporting may not be up-to-date. There are ways you can correct inaccurate information on your D&B business report without paying.

- Call the D&B customer service department at 800-234-3867 if you need to correct some information on your D&B credit report. Follow the instructions to discuss your own report.

- Get your D-U-N-S number from the iUpdate section at dnb.com, the D&B website, for listing your business in D&B’s database. After you provide business information about your company to create your credit profile you will receive the number via email in a few days. You can sign up for iUpdate to gain access to information online.

- Register as a user for iUpdate to view, print and submit updates to your D&B business information report. This helps keep your information current and complete, improving your credibility with banks and other companies. You can make changes to your information whenever you sign in. Sometimes, you will receive a phone call to verify the information you input.

- Contact customer service for billing disputes, challenging payments and outdated public filings that appear on your report. D&B will have vendors re-verify payments and remove charges if the vendor cannot verify the information. D&B also helps to clear up issues that have been settled or dismissed, yet still appear in your report. You may be asked to send in documentation to verify a settlement or dismissal. D&B will recheck the status of the public filing if you do not have documentation.

7. Know the differences between BUSINESS and PERSONAL credit scores

Bankrate created a guide about building a better business credit score and how it’s different from a personal credit score.